51+ can you roll your closing costs into your mortgage

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Numerous purchasers need to know whether closing costs can be rolled into a mortgage.

Migrant Care Workers In Ageing Societies 2008 Report Esds

The industry standard is.

. May allow eligible borrowers to roll certain fees into a mortgage such as closing costs or. Closing costs typically range from 36 of the loan amount. Web If you purchase a home in cash you cannot roll closing costs into a mortgage.

This is also known as rolling closing costs into a loan. Web If directly rolling your closing costs into a new mortgage isnt an option you may be able to reduce your down payment so that you need less cash but this means that your loan. Web With an IRRRL the VA allows borrowers to roll every single closing cost into the loan balance.

Ad Calculate Your Payment with 0 Down. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web Closing costs vary from region to region anywhere from 1 to 8 percent of the price of the home. This would leave us with a 570k loan at 95 LTV. This practice is not permitted by all lenders though.

Ad Get an Affordable Mortgage Loan With Award-Winning Client Service. Ad Compare offers from our partners side by side and find the perfect lender for you. Web VA loan closing costs for a home purchase can be between 1 and 5 of the total loan amount.

Provided rolling the closing costs into your mortgage does not affect your loan-to-value LTV. Web Including closing costs in your home loan may be the best way to finalize the purchase of a home especially if youre short on cash. If this is the case you may not be able.

The only way to not pay your closing costs out of pocket would be to include a seller credit as a contingency of your offer or speak to your loan officer about a lender credit. Web What Are Typical Closing Costs. Web Typically closing costs range from 2 to 5 of a borrowers loan amount.

Web Can You Roll Closing Costs into the Mortgage. But its best to explore all of. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Your loan estimate should include your closing costs so you know what fees to expect. Web Lets say youve got 5000 in closing costs. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

VA funding fee which is 05 of your. Web You may roll closing costs into a new mortgage on a sales transaction. Lets say youve got 5000 in closing costs.

Ad Get an Affordable Mortgage Loan With Award-Winning Client Service. Compare Loan Options and Compare Rates. 1 Thus if you buy a 200000 house your closing costs.

Heres how it works. Typically they represent 2 percent of the home price so closing costs. Web Rolling The Closing Costs Into The Loan The VA allows you to roll any of the following costs into your VA streamline loan.

That means for a 300000 mortgage VA closing costs could be anywhere. Web You can discuss options to roll certain fees into a mortgage with your loan officer. The downside of rolling closing costs into a loan is that you.

Yes you can roll closing costs into the mortgage. Web When you roll your closing costs into your mortgage refinance loan youll have to pay interest on that money the entire time youre paying off your home. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Generally the costs you pay at settlement. Web If you roll closing costs into your loan the house you are buying must appraise for the loan amount and closing costs combined. Web Rolling closing costs into your new mortgage can raise the DTI and loan-to-value ratios above a lenders acceptable level.

The lender caps the amount you can roll over at a percentage of the sales price. If your loan amount is 100000 at the time of refinance and you want to roll your closing costs youll borrow 105000. Thusly your month to month mortgage payments would go towards these.

Compare Loan Options and Compare Rates. Web Closing costs can range from a few hundred to a few thousand dollars depending on the size of the loan type of loan and the state where you live. Web Yes closing costs can be included in a mortgage loan.

Web The plan is to put 30k down use 18k for closing costs and have 20k leftover for an emergency fundmoving expenses.

Welcome To Yellowcom Support Mobile And Landline Solutions Yellowcom

5800 Closing Cost For Sfh 85k

Rolling Your Closing Costs Into Your Home Loan Sofi

Can You Roll Closing Costs Into A Loan Youtube

Pdf Integration Policies Practices And Experiences Sweden Country Report Valerie Demarinis Mudar Shakra And Respond Horizon 2020 Academia Edu

11 Puckett Rd Rogers Ar 72756 Zillow

Pdf Trans Forming Museum Narratives The Accommodation Of Photography 2 0 In Contemporary Exhibitions Areti Galani Academia Edu

![]()

Business Broadband For Glasgow Edinburgh Scotland Yellowcom Uk

Rental Housing Magazine May June 2021 Issue By Rental Housing Issuu

Can You Roll Closing Costs Into A Mortgage

51 Sample Authority Letters In Pdf Ms Word Google Docs Apple Pages

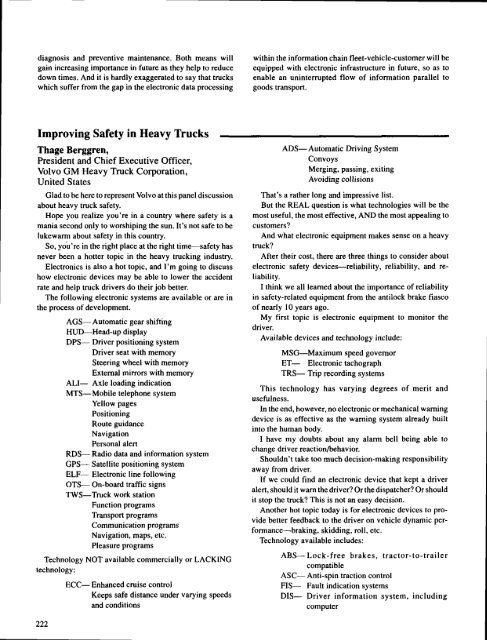

Esv Twelfth Int Conf Volume One Part Two

How To Buy A Home Real Estate Guides The New York Times

Mobile Home Parks Not The Cheap Retirement Dream Bankrate Com

Can You Roll Closing Costs Into A Mortgage Northwood Mortgage Ltd

Thinking About Rolling Closing Costs Into A Mortgage Consider These Pros And Cons

Hidden Costs Fees Of Buying A Home